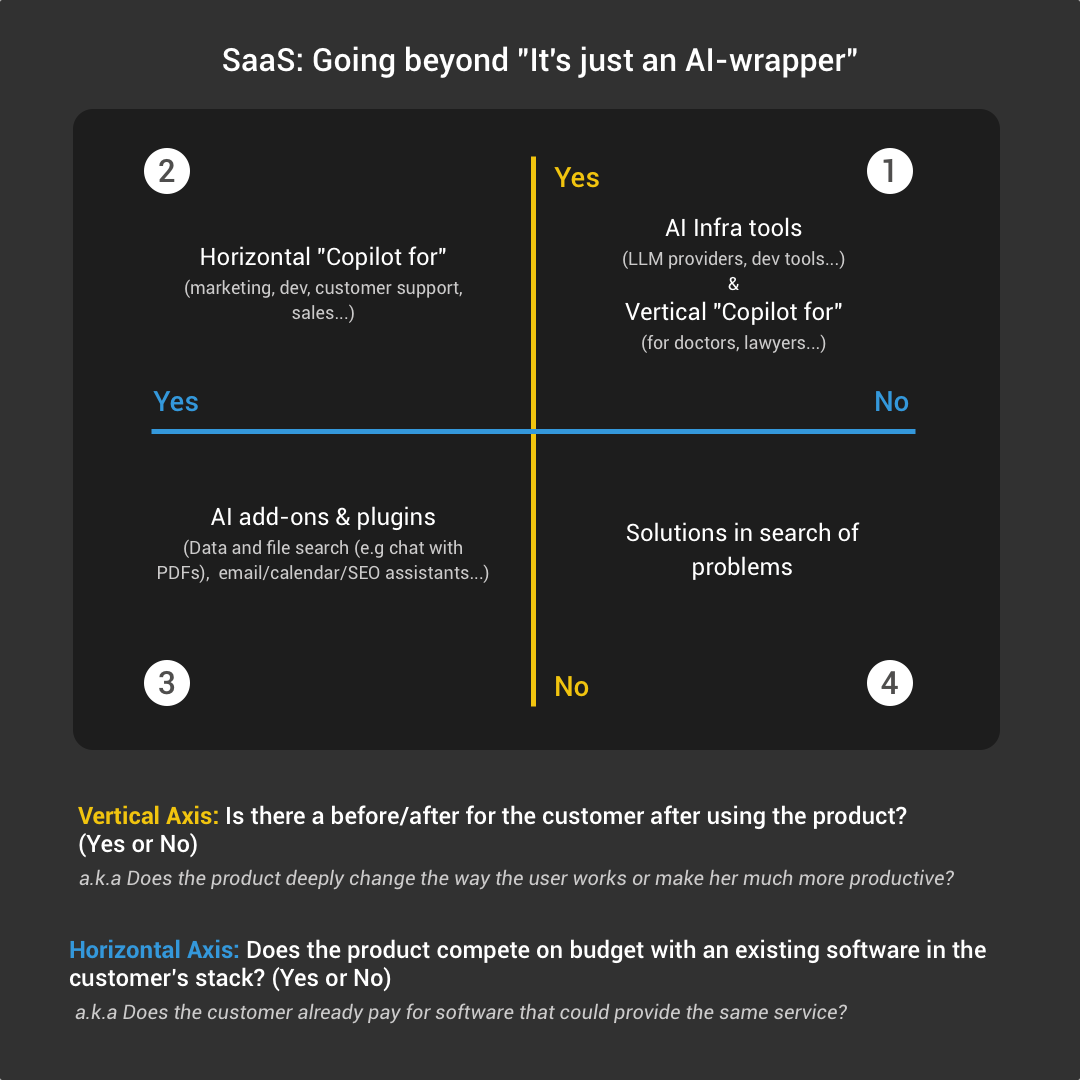

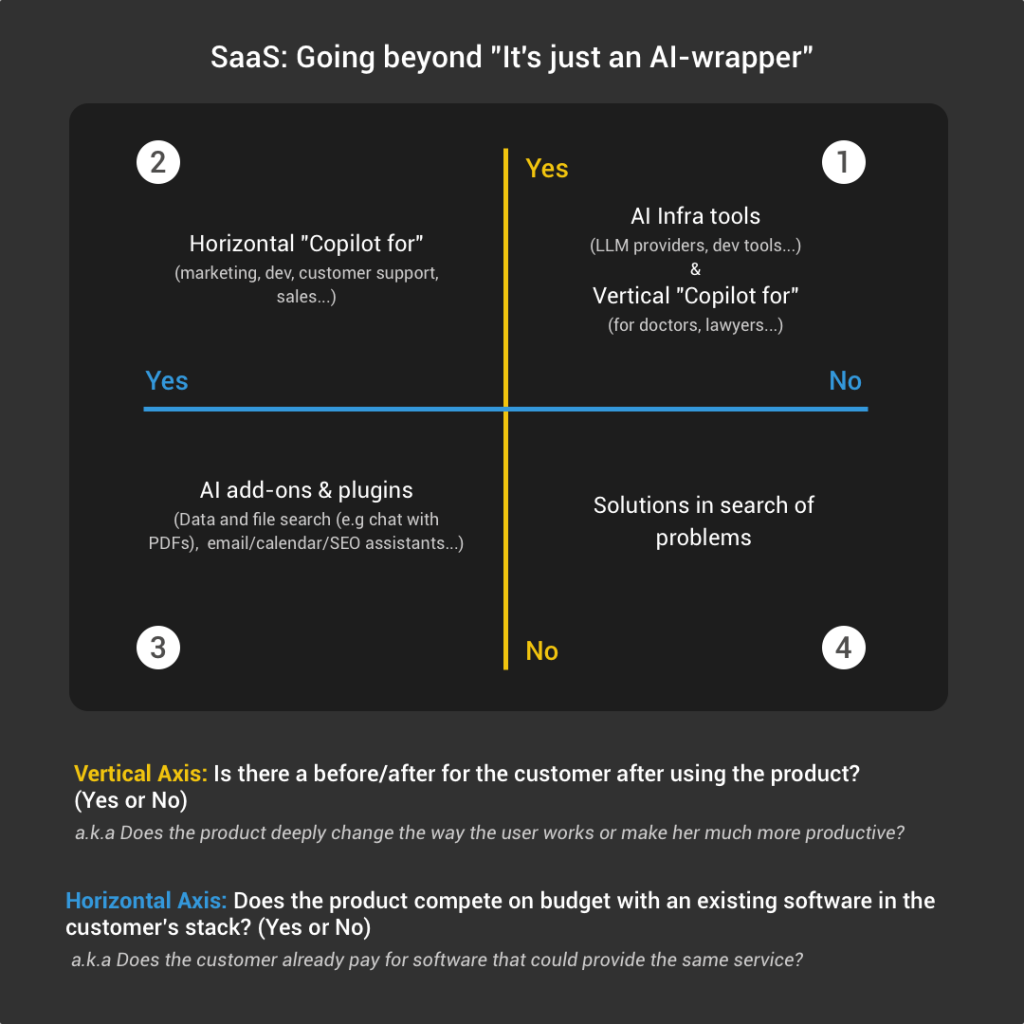

Quadrant #1:

These products provide a radical change which is hard for the customer to come back from. And these tools don’t compete on budget with existing similar apps in the customer’s stack.

- Examples: Many gen AI infrastructure tools from LLM providers to developer tools. Verticalized “Copilot for”: Copilot for lawyers, doctors, accountants etc…

- An aspect that can make a big difference in this quadrant is whether the product has some sort of defensibility or not (tech, data, brand, capital, network effect etc…). If you do, it’s harder to get copied.

Quadrant #2:

These products provide a radical change for the users but they already pay for software that could provide a similar service.

- Examples: Most of the horizontal/generalist “Copilot for” such as Copilot for developers, for content marketers, for customer support agents etc…

- When the incumbents don’t offer (yet) similar AI powered features, these tools can grow very fast.

- Once incumbents do offer similar features, then it can be harder to scale because they suddenly compete on budget. This is especially true for startups that are scaling or targeting mid-market/enterprise customers. Competing with Google, Microsoft, Salesforce (etc.) is extremely hard even if the product is better because you are competing more on budget than on product.

- IMO incumbent competition is less of an issue if you target smaller customers or if you are not scaling revenue yet (below a couple millions of ARR).

Quadrant #3:

In this quadrant you have the AI products that have a plugin or an add-on approach: They enhance existing products/platforms with AI for very specific use cases or for “non-core features”.

- Examples: Products that help retrieve information from PDF files, AI powered search or calendar/email/SEO assistants (etc.)

- IMO many of these tools can be amazing businesses if they are run as bootstrapped businesses.

- Since these tools are often built on top of existing platforms/software they can be good acquisition targets.

- But they also risk seeing platforms offer similar functionalities which might not kill small startups but for sure will limit their scaling potential.

Quadrant #4:

Many of these tools are either “solutions in search of a problem” or super niche products. So niche that you don’t have competing software in the space.

- Examples: I don’t want to give specific names. Just go on Product Hunt and check the startups under the “Artificial-intelligence” tag and you will see many examples.

- You also have the (very slim) chance that a product in this quadrant addresses a new market in a totally new way that no one saw coming. A bit like Airbnb when they started. These are the ultimate outliers. So it can make sense to keep an eye on the startups in this quadrant.