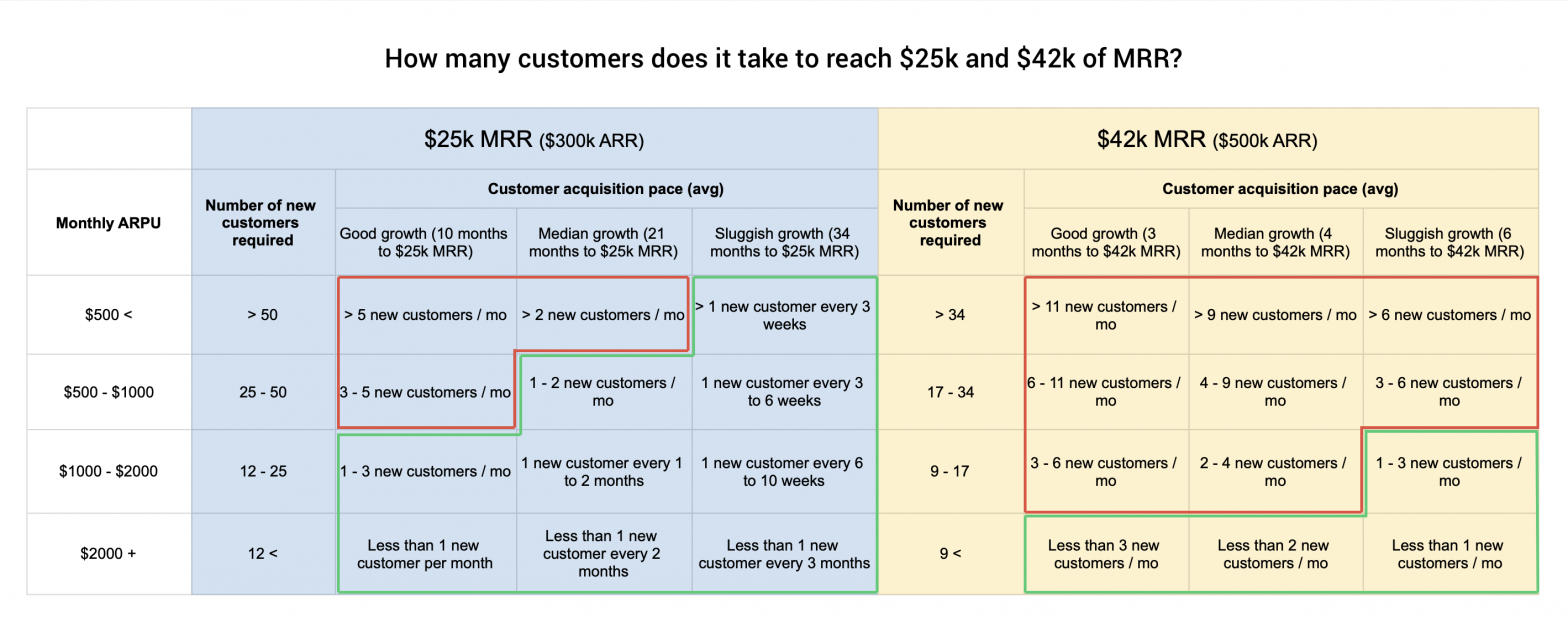

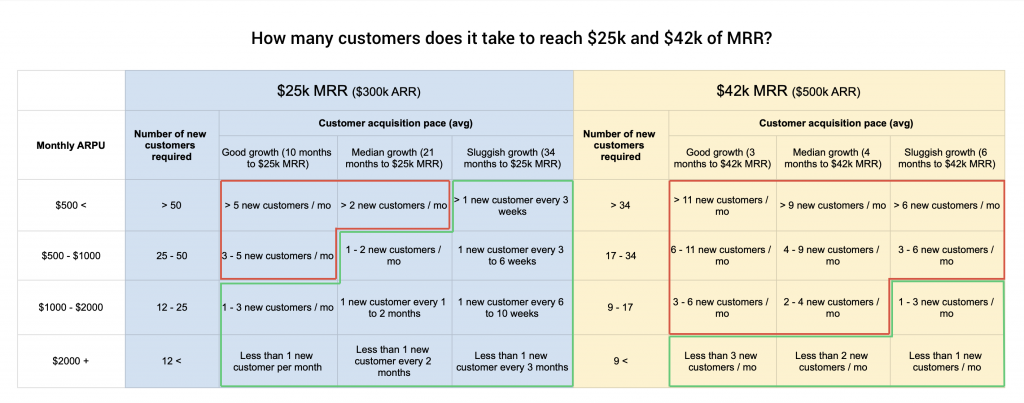

In a previous post I explained why I think that revenue generation in early stage SaaS startups should be founder-led. Below you can see a table that I use to visualize how many customers it takes for a SaaS startup to reach $25k and then $42k of MRR, depending on its monthly pricing/revenue per customer.

About the table:

- First column “Monthly ARPU”: I broke down the monthly revenue per customer in these ranges because it’s what I personally see most of the time. The vast majority of SaaS founders I speak with generate between a couple of hundreds of dollars and 2000$ of revenue per customer (monthly). I’m not saying it reflects the market, it’s just what I see personally.

- Second column “Number of customers required”: The number of customers you need to reach $25k and $42k of MRR depending on your pricing/ARPU.

- Third column “Average customer acquisition pace”: Now that we have the number of customers needed to reach these MRR marks, I use ChartMogul’s growth benchmark to see what is the average pace of customer acquisition needed (a.k.a the number of new customers you need to acquire monthly) depending on the growth profile (Good, median and sluggish growth).

- About churn and acquisition pace: I didn’t integrate churn in this table and I know that customer acquisition is not something “predictable/regular” at an early stage. But the aim of this table is more to show what “broad” numbers you need to hit rather than a precise plan.

Takeaway#1: You probably don’t need to hire a marketing or sales person to reach $25K MRR

- If you need to hire a marketing or sales person to reach $25k MRR, then there’s probably a problem. At that stage I meet many founders who want to hire someone to help them with revenue generation, whereas in reality they could do it by themselves. I see two main scenarios here, which are highlighted in green and red borders.

- Green border cells: Do things that don’t scale and outbound. In the green border cells you need to acquire between 1 and 50 customers in total to get to $25k MRR with a maximum pace of 3 new customers per month (and it’s in the case you have very good growth). To hit these numbers you don’t need a very complex strategy. In most cases by doing “things that don’t scale” and smart outbound you can get there. I often see founders doing that by leveraging their own network, by doing smart cold outbound, going to trade fairs, by leveraging their existing customers to get more customers etc. What often makes the difference is execution, perseverance and focus. I’m not saying that it’s easy (it’s hard), but just that you don’t need to hire a marketing or sales employee to do that for you.

- Red border cells: Strong product interest or word of mouth is necessary. Here to reach $25k of MRR you need more than 50 customers at a pace above 3-5 customers per month. It’s very hard to achieve this by only doing things that don’t scale. You usually need some kind of inbound traction or strong product interest/word of mouth which are hard to create. You either have it or not. This is why in this zone outbound is required, but you also definitely need a first product/distribution momentum. If you don’t, it will be hard. And hiring a marketing or sales employee will likely not solve this problem.

- You might have a PMF or product problem rather than a marketing or sales problem. If in both cases (green and red) despite relentless execution you cannot grow your revenue, then you have a PMF or product problem rather than a revenue generation problem.

- Theory versus practice: Hiring the first revenue generation employee can make sense when your customer acquisition pace accelerates. In reality, customer acquisition pace is often not linear (unlike on my table). If you are lucky, your acquisition pace will be slow at the beginning and will accelerate with time as your product gets better and as you get better at selling your software. Once you start to have a first repeatable acquisition mini-playbook that works, it can make sense to hire someone to help with revenue generation. So if you see this acceleration at $15k of MRR, for example, it can be a good time to start hiring.

Takeaway #2: To grow to $42k MRR you need to have a mini acquisition playbook and compounding effects that start to kick in

- Acquisition pace accelerates across the board and doing things that don’t scale is often not enough. As you can see on the table, there’s an acceleration in terms of acquisition pace across the board. Getting more than four new customers per month by only doing things that don’t scale can be hard. This is why a first repeatable acquisition mini-playbook and compounding effects are important.

- The first repeatable acquisition mini-playbook and hiring the first revenue generation employees (marketing or sales). As I mentioned in the previous section, it’s during the $1k – $25k phase that founders usually build this mini-playbook. It’s something that is built through trial and error and takes many iterations. It will not appear suddenly at $25k MRR.

The importance of compounding effects. Another aspect that shouldn’t be overlooked are the various compounding effects that can kick-in at that stage. Very often a person needs to be exposed to your brand/product more than 8-10 times before she tries it. So, if over the course of the past 12 to 24 months you have done a good job at showing your product, contacting potential leads, being active on social media (etc.) even if it didn’t immediately translate to sales, the compounding effect of this exposure can start at that stage. Same with direct sales: A failed outbound sale in the $1k – $25k phase can lead to an inbound or a word of mouth sales months later. Same with better word of mouth acquisition once your product gets better. And same with outstanding customer service at the very early stage that can lead to great word of mouth acquisition down the line. These are all “compounding effects” that start at the earliest stage, but really kick-in months later.