In my last post about founder-led revenue, I broke down the path to $100k MRR into three stages:

- $1k to $25k MRR

- $25k to $50k MRR

- $50k to $100k MRR

But there was no data on how long it takes to reach these thresholds.

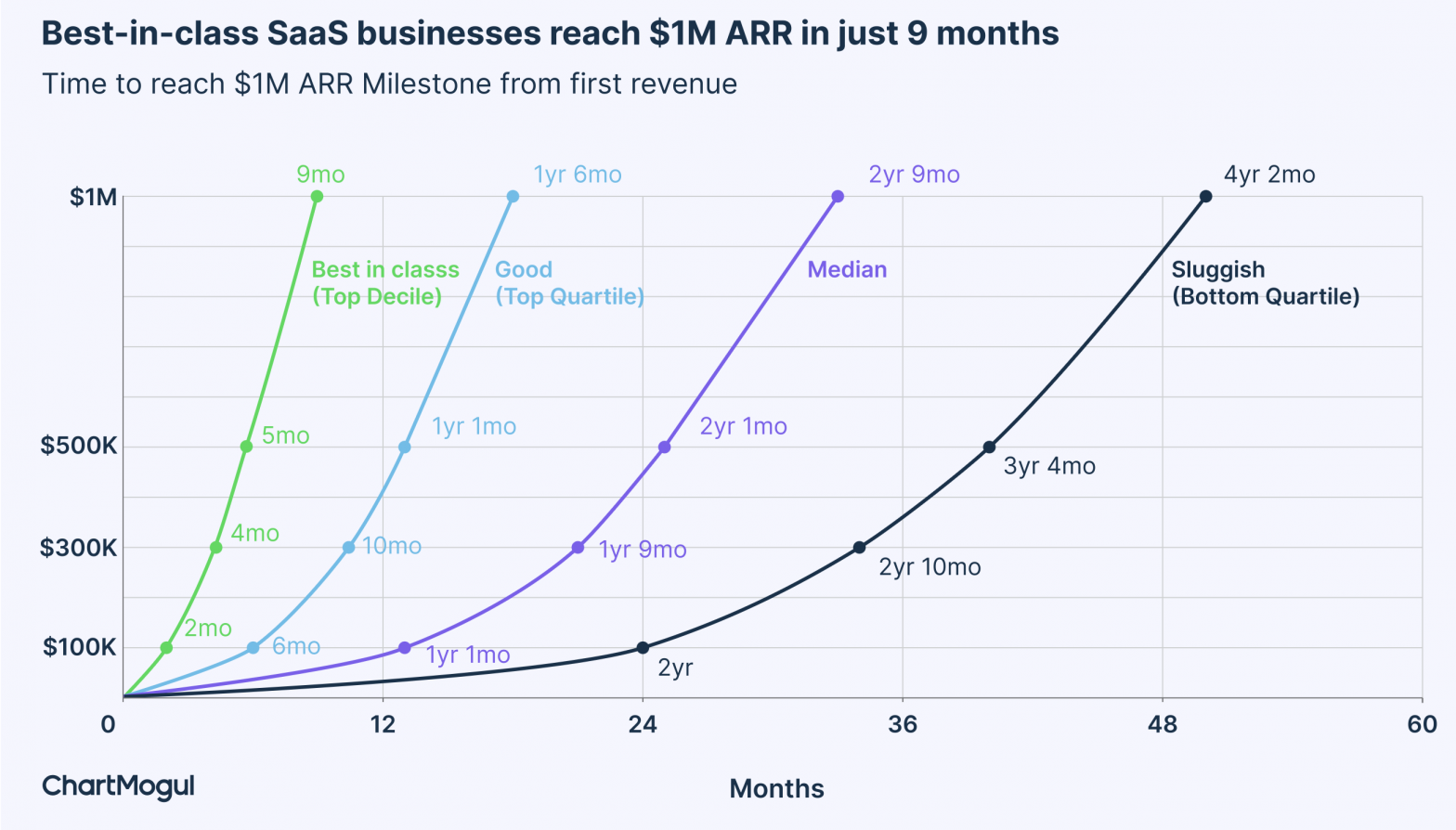

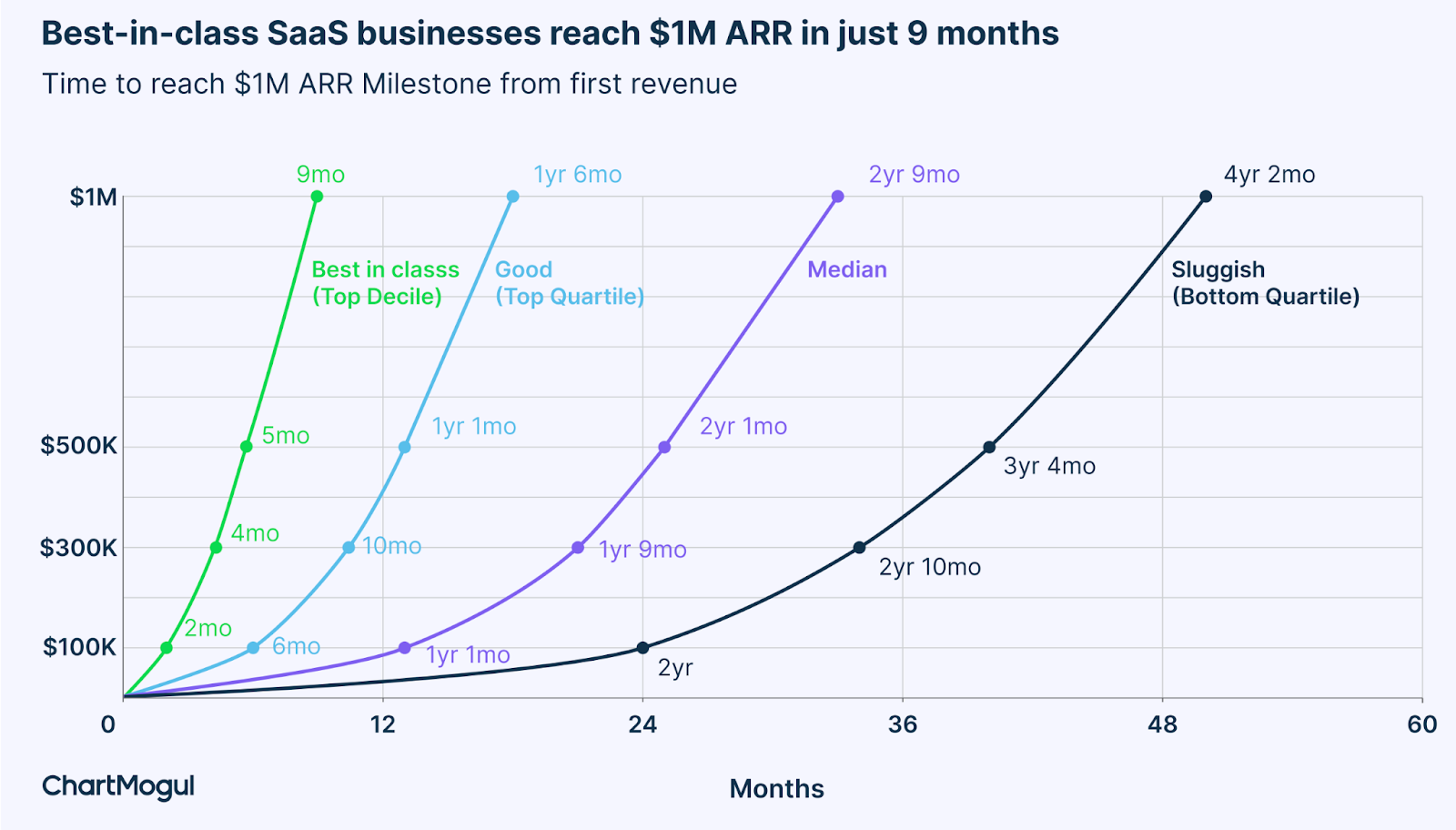

Chartmogul released a great report (which I highly recommend) where you can see real data about this journey. Be aware that the starting point for these milestones is not the founding date of the company but after the first customer. So keep in mind that some companies can spend months/years building the product before they get their first customer.

For the typical (median) startup the journey looks like this:

- $1k to $25k MRR => 1y9mo

- $25k to $40k – k$50k MRR => 4mo

- $50k to $80k MRR => 8mo

So a total of 2y9mo to go from the first customer to $1M ARR.

In comparison, the journey for the top decile startup looks like this:

- $1k to $25k MRR => 4mo

- $25k to $40k – k$50k MRR => 1mo

- $50k to $80k MRR => 4mo

So a total of 9 months to go from the first customer to $1M ARR.

Looking at the graph several aspects struck me:

- Regardless of their growth speed, in this survey all startups accelerate after the $100k / $150k ARR mark. It means that once you have found a first PMF and you manage to keep growing, your growth likely won’t be linear but will accelerate.

- For instance, even for the startups with sluggish growth it takes 3 years and 4 months to reach $500k ARR and then only more 10 months to add the same amount of ARR and reach $1M ARR.

- The other aspect that struck me is how it’s the very early stage that makes the difference between all these startups. The top decile startup will take only 4 months after its first customer to reach $25k MRR whereas the startups with sluggish growth will take 2y10mo (8.5 times longer). But there is a huge time compression once the $500k ARR mark is reached. The top decile startup takes 4 months to reach $1M ARR and the startup with sluggish growth takes 10 months (2.5 times longer).

Of course there’s a survivor bias here as the survey includes only the startups that have reached this milestone and not the ones that died on the way or that are stuck below the $1M ARR mark. But I would guess that the vast majority of the deaths happen prior to the $100k – $200k ARR. So if you can hold on until there, then there is light at the end of the tunnel.