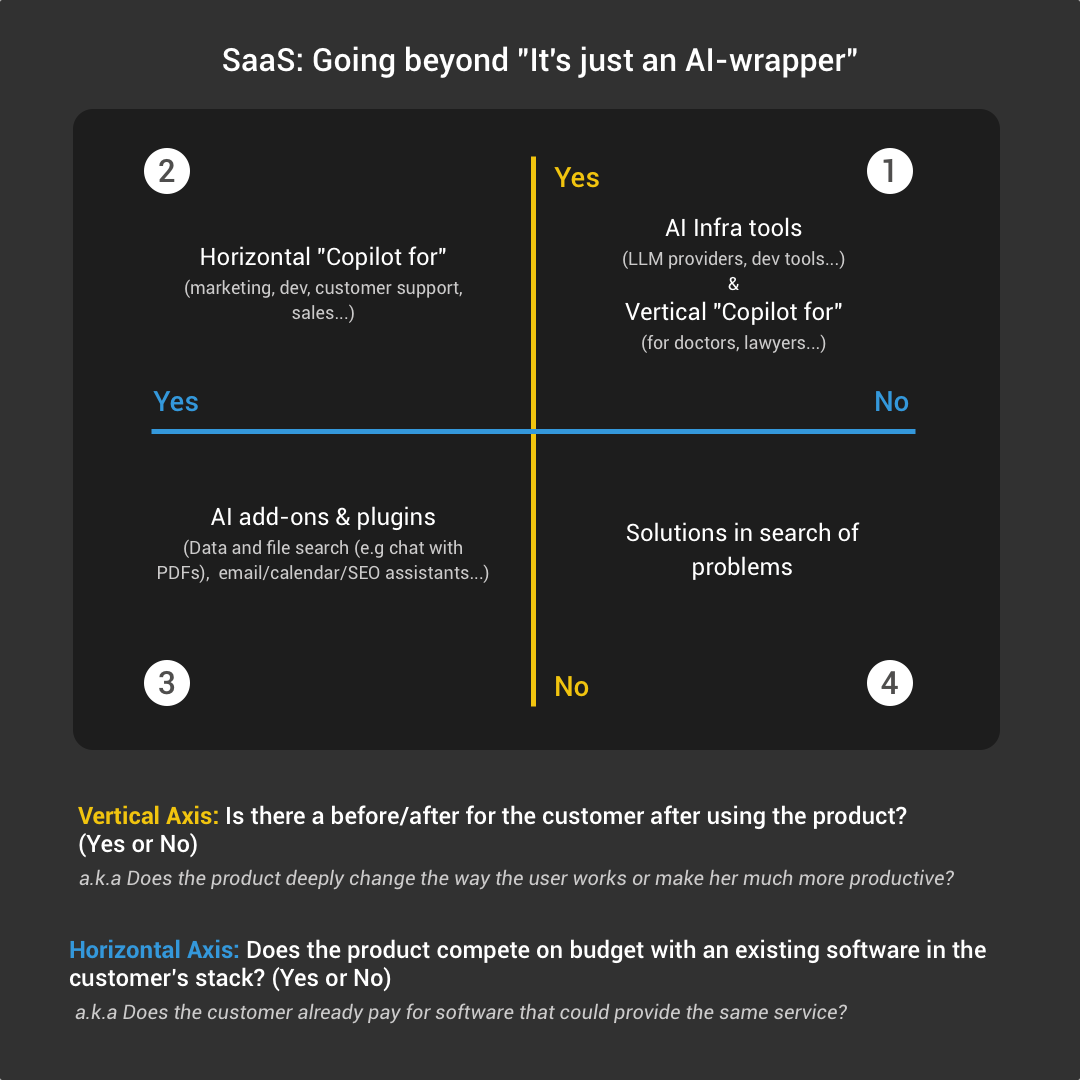

Quadrant #1: These products provide a radical change which is hard for the customer to come back from. And these tools don’t compete on budget with existing similar apps in the customer’s stack. Quadrant #2: These products provide a radical change for the users but they already pay for software that could provide a similar… Continue reading SaaS: Going beyond “It’s just an AI-wrapper”

Author: clement

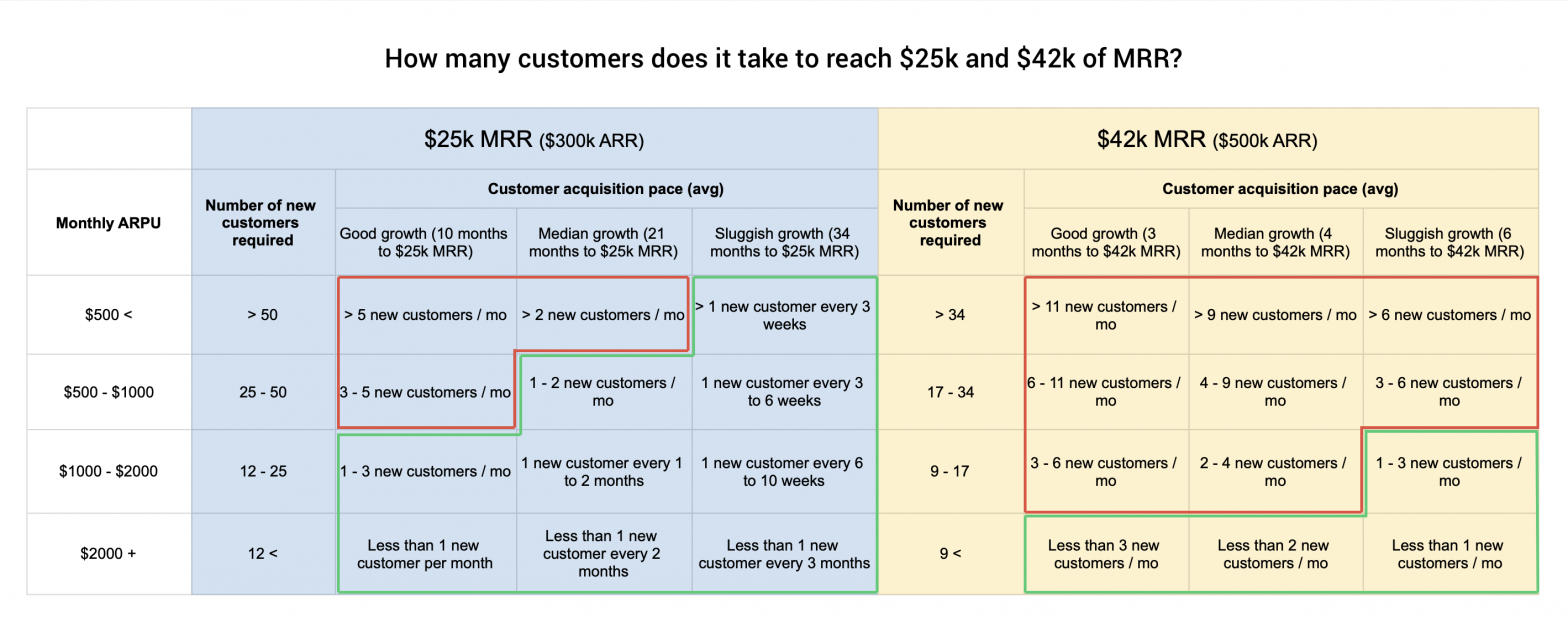

How many customers does it take to reach $25k and $42k of MRR?

In a previous post I explained why I think that revenue generation in early stage SaaS startups should be founder-led. Below you can see a table that I use to visualize how many customers it takes for a SaaS startup to reach $25k and then $42k of MRR, depending on its monthly pricing/revenue per customer.… Continue reading How many customers does it take to reach $25k and $42k of MRR?

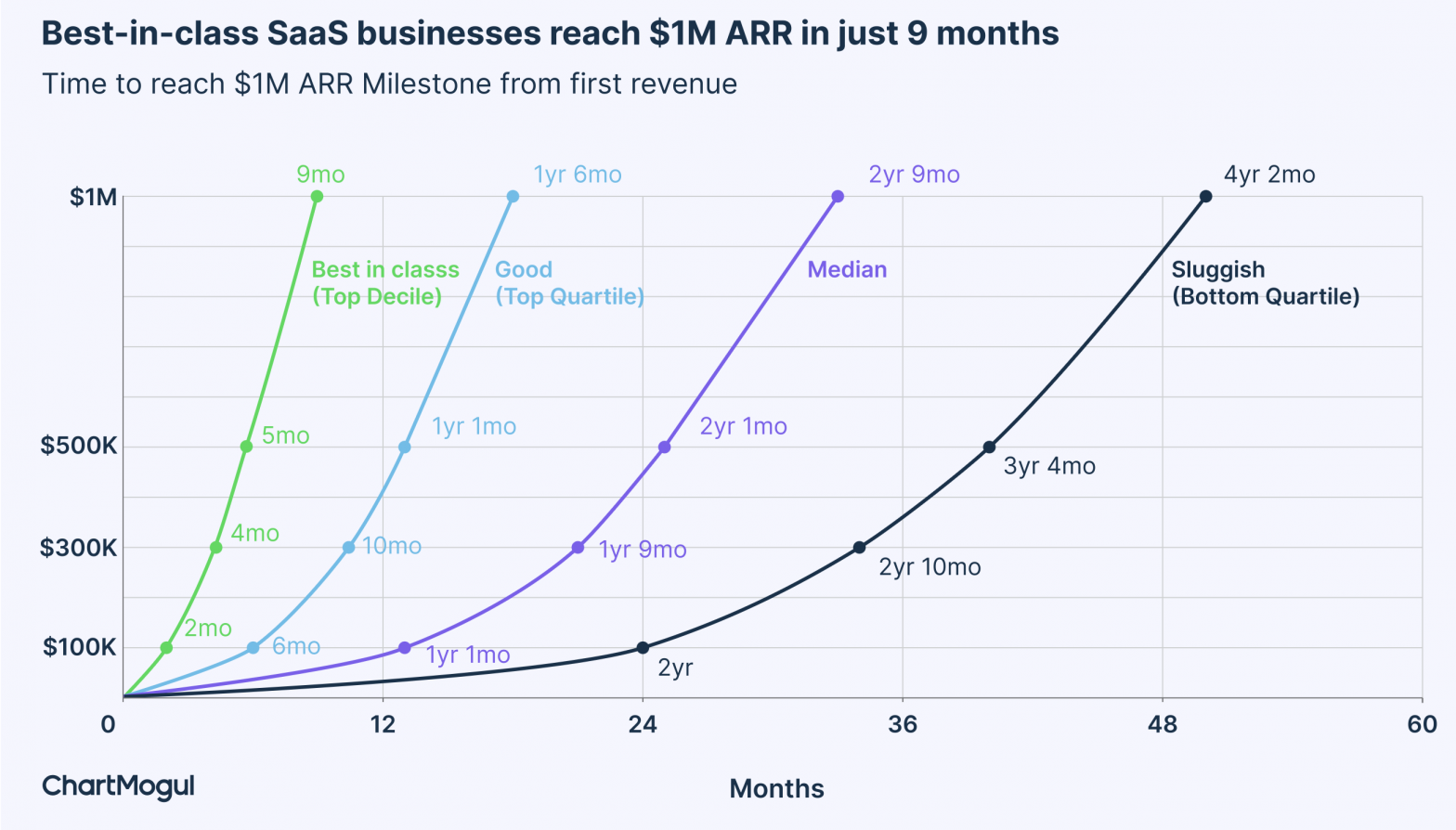

How long does it take to reach $1M ARR?

In my last post about founder-led revenue, I broke down the path to $100k MRR into three stages: But there was no data on how long it takes to reach these thresholds. Chartmogul released a great report (which I highly recommend) where you can see real data about this journey. Be aware that the starting… Continue reading How long does it take to reach $1M ARR?

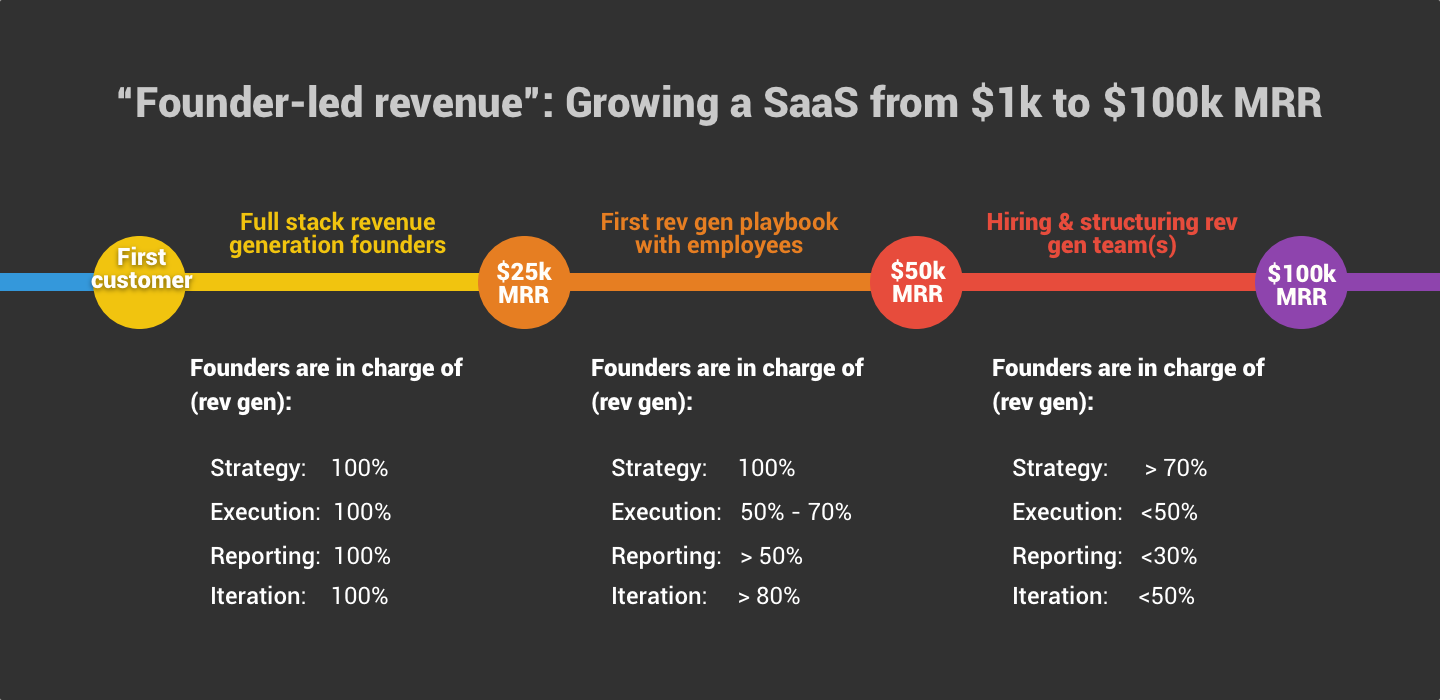

Founder-led revenue: Growing a SaaS from $1k to $100k MRR

The past couple of weeks I’ve been working with several early stage SaaS founders who are in the 0-$10k MRR range. A common theme that came back across these different projects was about why the first $100k of MRR should be “founder-led” revenue versus hiring an experienced person to be in charge of revenue generation… Continue reading Founder-led revenue: Growing a SaaS from $1k to $100k MRR

The Incremental SaaS Playbook: A Founder’s Perspective

This post is the third part of a series covering the age of the “Incremental SaaS”. In this one I focus on the consequences of building an incremental SaaS from a founder perspective. 1. It’s ok to bootstrap first and raise later (>$1M ARR) I always had issues with opposing the bootstrap and VC models.… Continue reading The Incremental SaaS Playbook: A Founder’s Perspective

Is your SaaS Radical or Incremental?

In my previous post I wrote about what I call the age of the “incremental SaaS”. In this article, I dig a bit more into what the term “radical SaaS” covers and how I distinguish radical from incremental SaaS. Radical SaaS: Creating a “before and after” effect I use the term “radical” in the literal… Continue reading Is your SaaS Radical or Incremental?

Consequences of the incremental SaaS era from a VC perspective

In a previous post I explained how I personally believe that in the traditional B2B software categories (productivity, sales and marketing software, developer tools, analytics etc…) we now see many more “incremental SaaS” than “radical/category defining SaaS”. And how it changed my perspective when it comes to pre-seed/seed SaaS financing. In this post I will… Continue reading Consequences of the incremental SaaS era from a VC perspective

B2B software: Investing in the age of the “Incremental SaaS”

The past 12 months I felt a bit uncomfortable with the early stage VC funding environment. And not only because of the sky high valuations that we saw last year. But I couldn’t articulate precisely why. This is why I decided to take the time this summer to do some introspection and to try to… Continue reading B2B software: Investing in the age of the “Incremental SaaS”

How should I assess “dashboard startups”?

I recently had a discussion with a fellow investor about what I call “dashboard startups”. These are products that enable users to aggregate data from various sources to then visualize it on a dashboard. We had this discussion because we were both looking at such a company and both of us have maybe the wrong… Continue reading How should I assess “dashboard startups”?

The democratization of consumer investing

Consumer investment apps have been around for quite some time now. Whether it’s robo advisors such as Betterment or stock trading apps like Robinhood. However I’m wondering if the market for consumer investment apps is not going to accelerate in the years to come due to several market forces. The first one is market education.… Continue reading The democratization of consumer investing